Adding members to your LLC can be an exciting sign of growth, and an opportunity to bring in a trusted partner, an investor, or transition from a one-person operation into a collaborative business.

But are you ready for the next steps? Because if you don’t handle this process correctly, you could face disputes, tax headaches, and even compliance penalties.

In today’s doola guide, we’ll break down everything you need to know about how to add members to your LLC operating agreement, from the legal steps and tax implications to the mistakes you absolutely want to avoid.

By the end, you’ll not only understand the amendment process but also see how doola can make your LLC compliance seamless and stress-free.

Understanding an LLC Operating Agreement

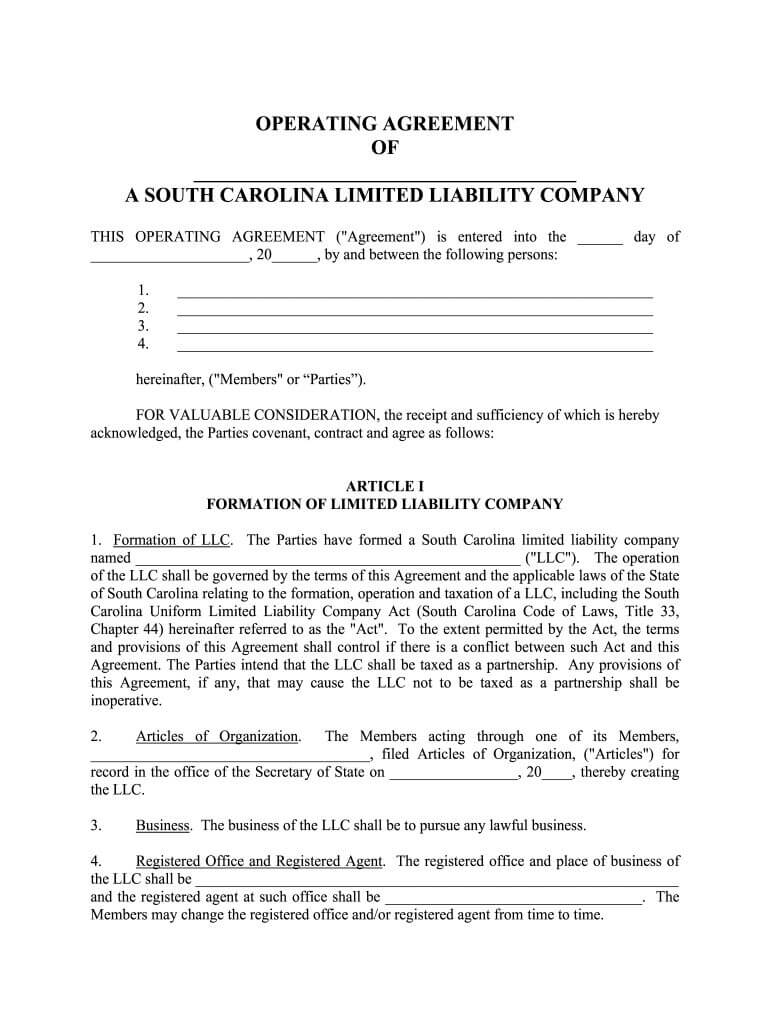

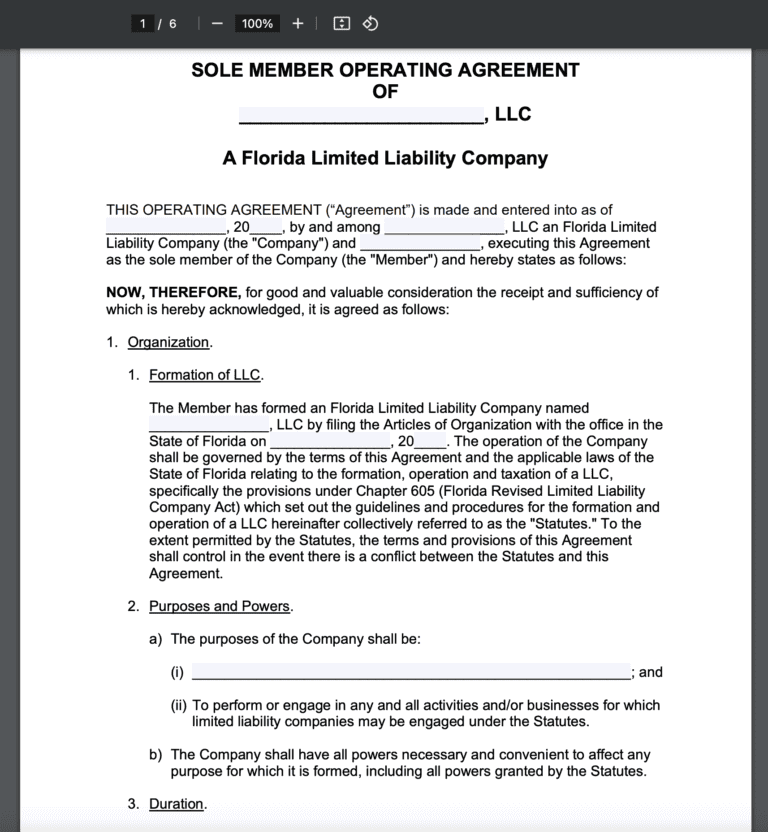

The LLC operating agreement, also known as an LLC agreement, is the blueprint of your business. It establishes how your company runs, how decisions are made, and how conflicts get resolved. It is “the rulebook” that outlines ownership and keeps everyone on the same page.

At its core, an operating agreement defines:

- Ownership structure: Who owns what percentage of the business.

- Profit and loss distribution: How money flows between members.

- Decision-making processes: Who gets a say in major business moves.

And interestingly, it doesn’t just sit in a drawer. Every time there’s a change in ownership or membership, this agreement needs to be updated to reflect your current reality.

Once signed, the operating agreement becomes a legally binding contract, between the members themselves and between the members and the LLC. It serves as a constant point of reference throughout the company’s lifespan, ensuring clarity and consistency.

Without an operating agreement, you will default to your state’s LLC laws. Those rules may not align with how you want to run the business, so if you don’t have one, you should draft one now.

When Do You Need to Add Members?

Before you rush to update your LLC’s operating agreement, it’s important to pause and ask: Do I really need to bring in new members?

Because adding someone to your LLC isn’t just about sharing the workload. It reshapes the ownership, decision-making power, and profit-sharing too.

Here are the most common situations where you will need to amend your operating agreement:

1. Bringing in New Business Partners

As your business scales, you may find that managing operations, finances, marketing, and customer relations is simply too much for one person. This is when bringing in a trusted business partner can make sense.

Beyond just easing your workload, partners can contribute specialized expertise, whether in finance, operations, legal, or strategy, that strengthens your business foundation.

In some cases, you may even add a member in an advisory capacity, giving your LLC access to valuable knowledge and networks.

2. Adding Investors

When capital is one of the direct drivers for expansion, investors may ask for equity in exchange for funding. But not every LLC is ready, or should be eager, to hand over their ownership stakes.

So before offering membership to investors, evaluate your funding needs carefully:

- Do you require significant capital to scale operations, enter new markets, or develop products?

- Can the business sustain growth without equity financing, perhaps through loans or reinvested profits?

- What long-term influence will investors have on decision-making and company culture?

Granting membership to investors is a long-term partnership. When done strategically, it could provide both resources and credibility. But if rushed, it may create conflicts or dilute your vision.

🔖 Related Read: Find the Perfect LLC Funding Option: Fuel Your Business Growth

3. Transitioning from a Single-Member to a Multi-Member LLC

Many LLCs begin as one-person ventures, but over time, the demands of growth might require more hands, more skills, and more capital.

Transitioning to a multi-member LLC lets you spread responsibility, attract complementary expertise, and strengthen your business’s financial footing.

This transition, however, should be carefully evaluated:

- Consider whether existing resources are being stretched thin

- Whether outside perspectives could spark innovation, or

- Whether expanding the ownership team could open doors to new markets.

Done right, it’s a powerful step in transforming a small venture into a resilient business.

Each of these three scenarios directly affects your LLC’s ownership structure, voting rights, and profit distribution.

That’s why every change must be reflected in your operating agreement and aligned with state laws to ensure compliance.

🔖 Related Read: How to Fill Out an Operating Agreement for Single Member LLC Owners

Step-by-Step: How to Add Members to Your LLC Operating Agreement

After you’ve carefully weighed the why behind expanding your LLC’s membership, the next challenge is figuring out the how. That’s where structure and process matter most.

Here’s your step-by-step roadmap for navigating the process:

Step 1: Review the Current Operating Agreement

Start by checking if your agreement already outlines how new members can be added.

Some agreements require unanimous consent; others may allow a majority vote. Check if your agreement already outlines the following aspects in detail:

- Do you need unanimous consent from existing members, or will a majority vote suffice?

- Is there a limit on how much of the company can be transferred or sold to a new member

Because the agreement functions as a legally binding contract, it’s essential to follow these procedures. Doing so not only keeps you compliant but also demonstrates that your LLC respects its own governance framework.

What if your agreement doesn’t list the terms about adding new members?

In that case, you’ll need to follow the default rules set by your state’s LLC laws.

In some states, this can be as straightforward as a vote, while in others it may require dissolving your current LLC and forming a new one.

But before you take such a major step, it’s wise to consult experts. At doola, we can walk you through your options and help you decide the best way forward.

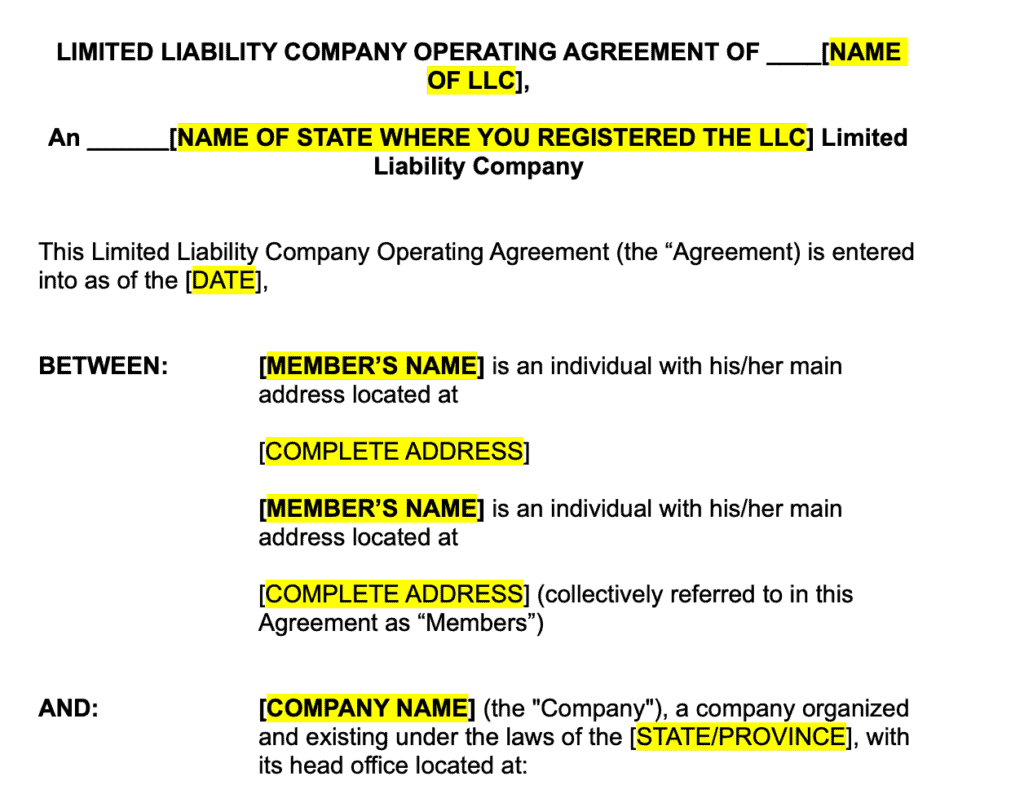

Step 2: Obtain Member Approval

The next step is securing approval.

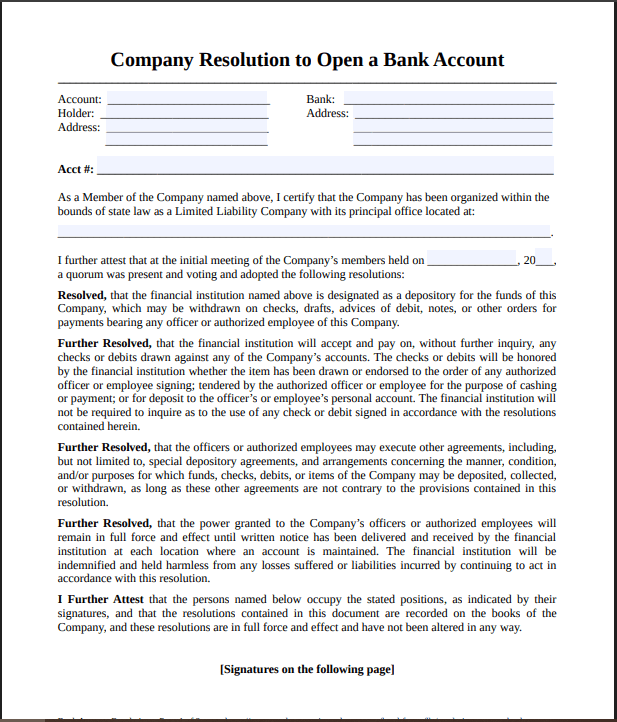

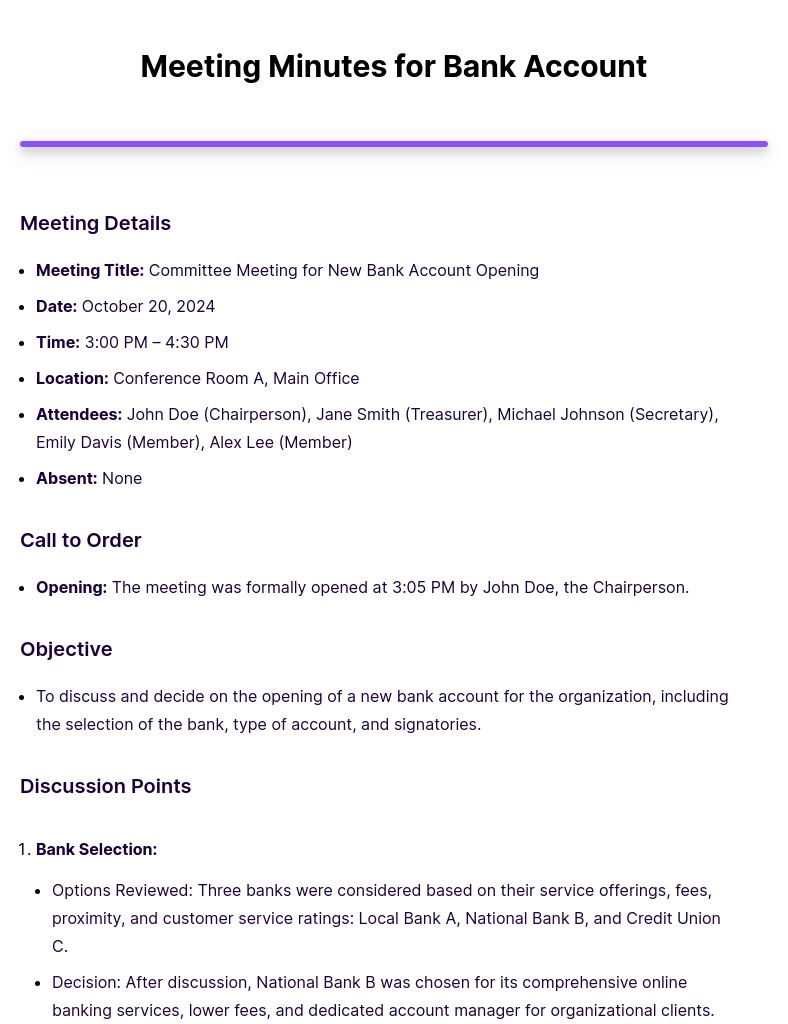

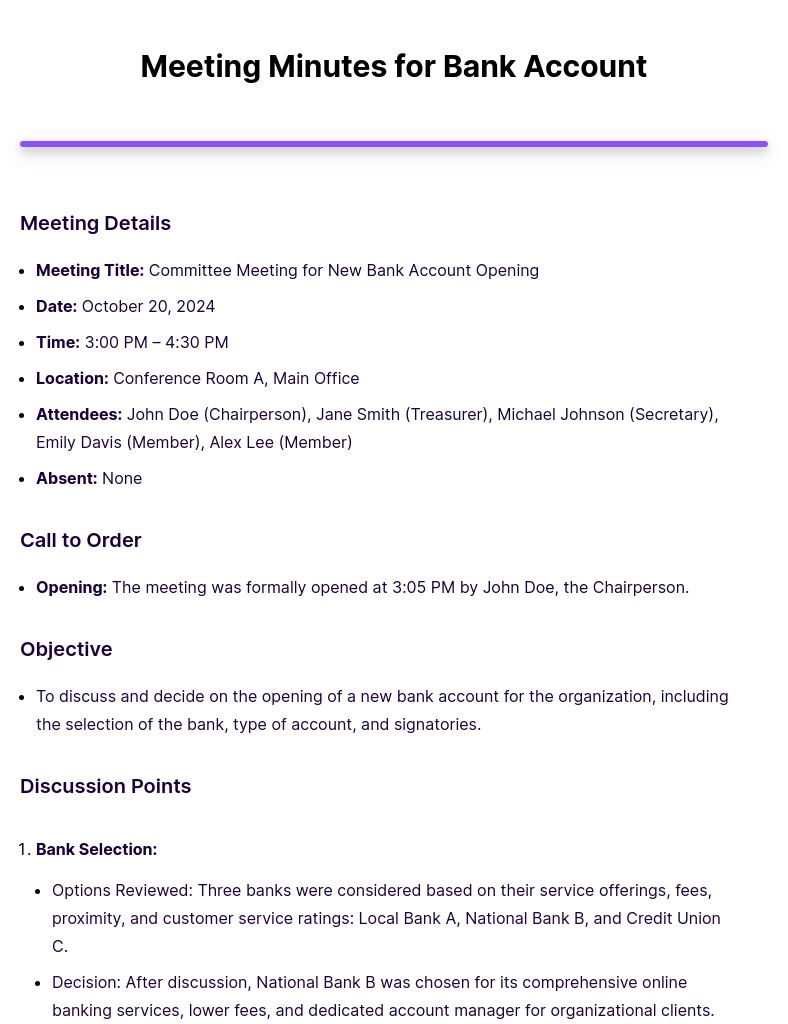

Hold a meeting with existing members and document their votes. Be it a majority or unanimous approval, record their decision in official “meeting minutes”.

Depending on your agreement (and in many states by default), the vote to admit a new member must be unanimous.

In other words, every current member needs to agree before the change is official. In either case, be sure to clearly outline each member’s ownership percentage in writing.

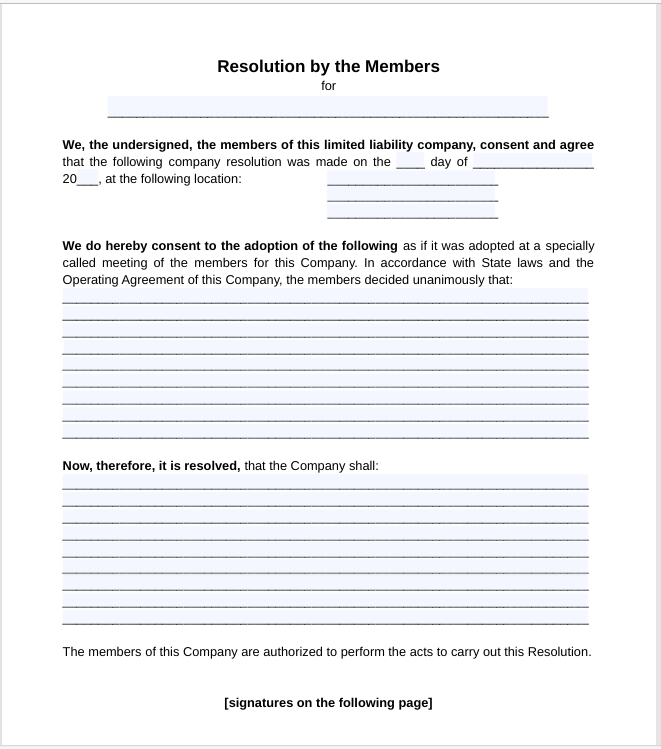

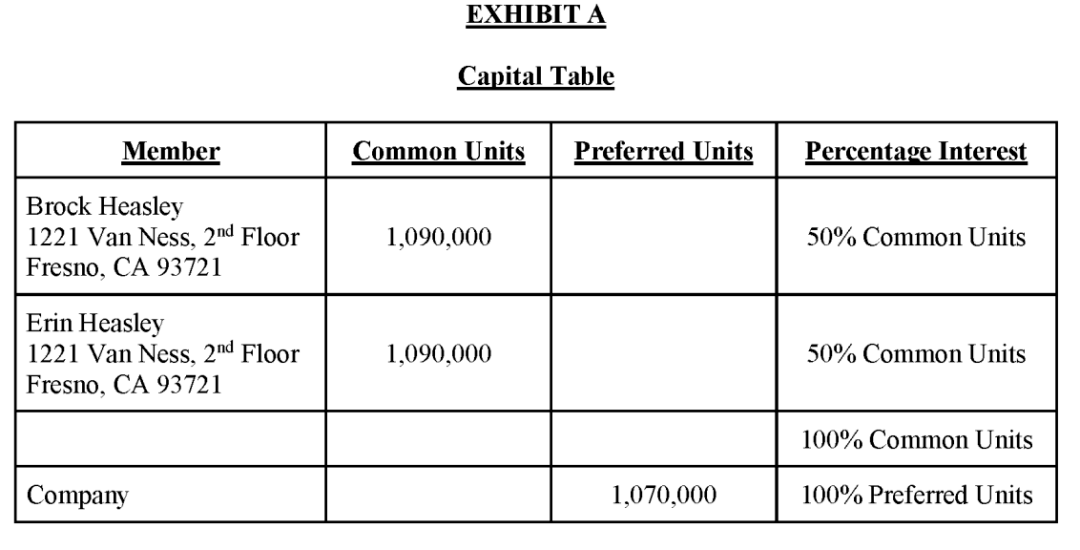

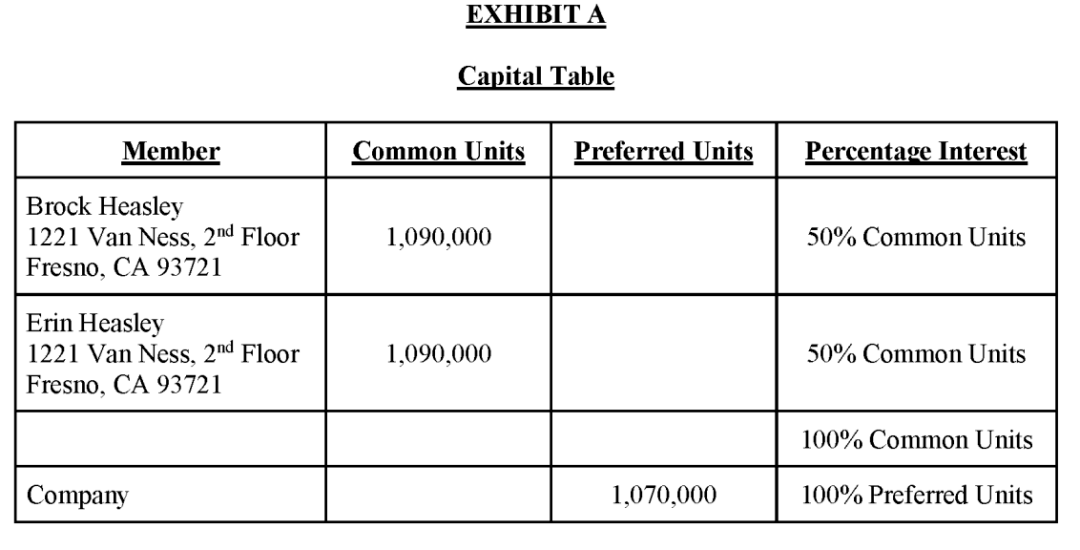

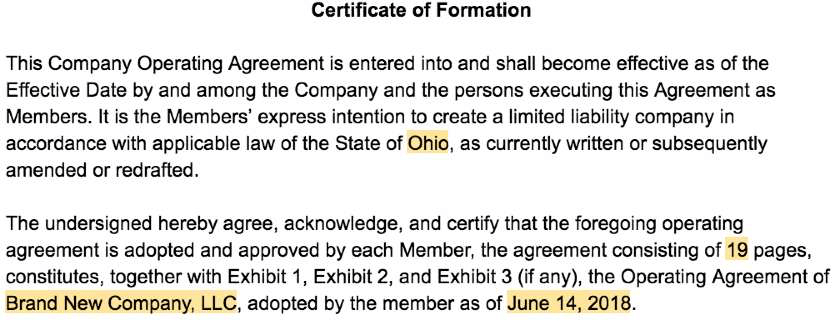

The example below highlights how to explicitly list interest percentages for your LLC members:

✔️ But what if not everyone is on board?

A discordant vote doesn’t have to end the conversation.

If members can’t reach an agreement, it’s often a sign that the proposed terms need another look.

Disagreements typically arise around ownership stakes or profit allocations, two numbers that don’t necessarily have to match. Adjusting the terms may help members reach common ground.

✔️ What about voting rights?

Not every LLC member needs to have voting rights. In a manager-managed LLC, day-to-day decisions are made by designated managers, who may or may not be members.

In some cases, only certain members are given voting authority over major decisions, like selling the company or winding down operations.

Your operating agreement should make these distinctions clear, so there’s no confusion about who has the power to approve new members.

✔️ What if it’s just you?

If you run a single-member LLC, the process is simpler.

You’re the sole decision-maker, so adding members only requires you to formally record your own approval. This decision should be documented and stored with your formation papers and other key business records.

Until you bring in additional members, you maintain full control and flexibility over how your operating agreement evolves.

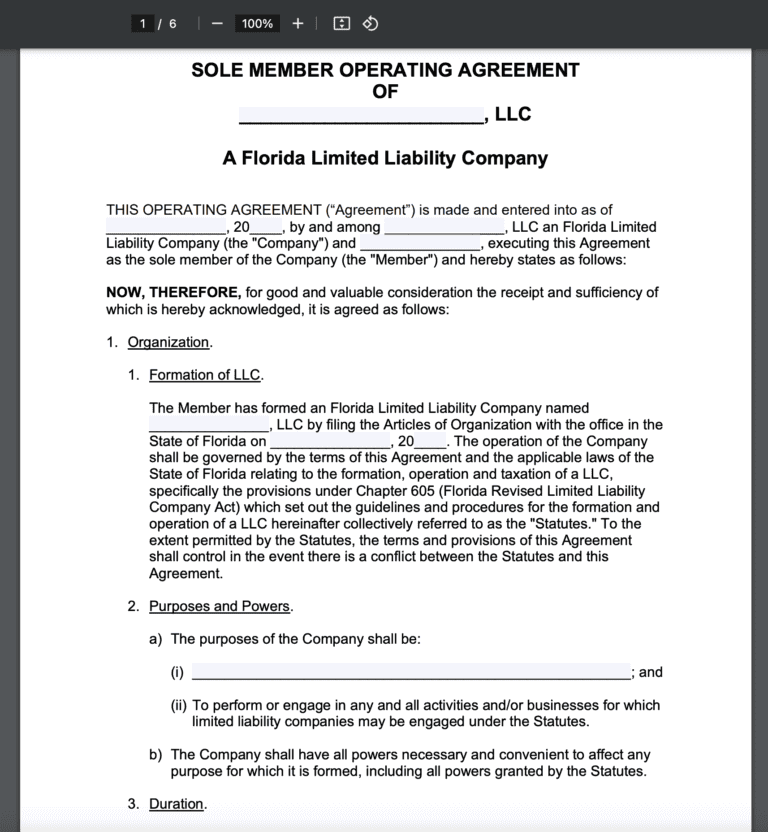

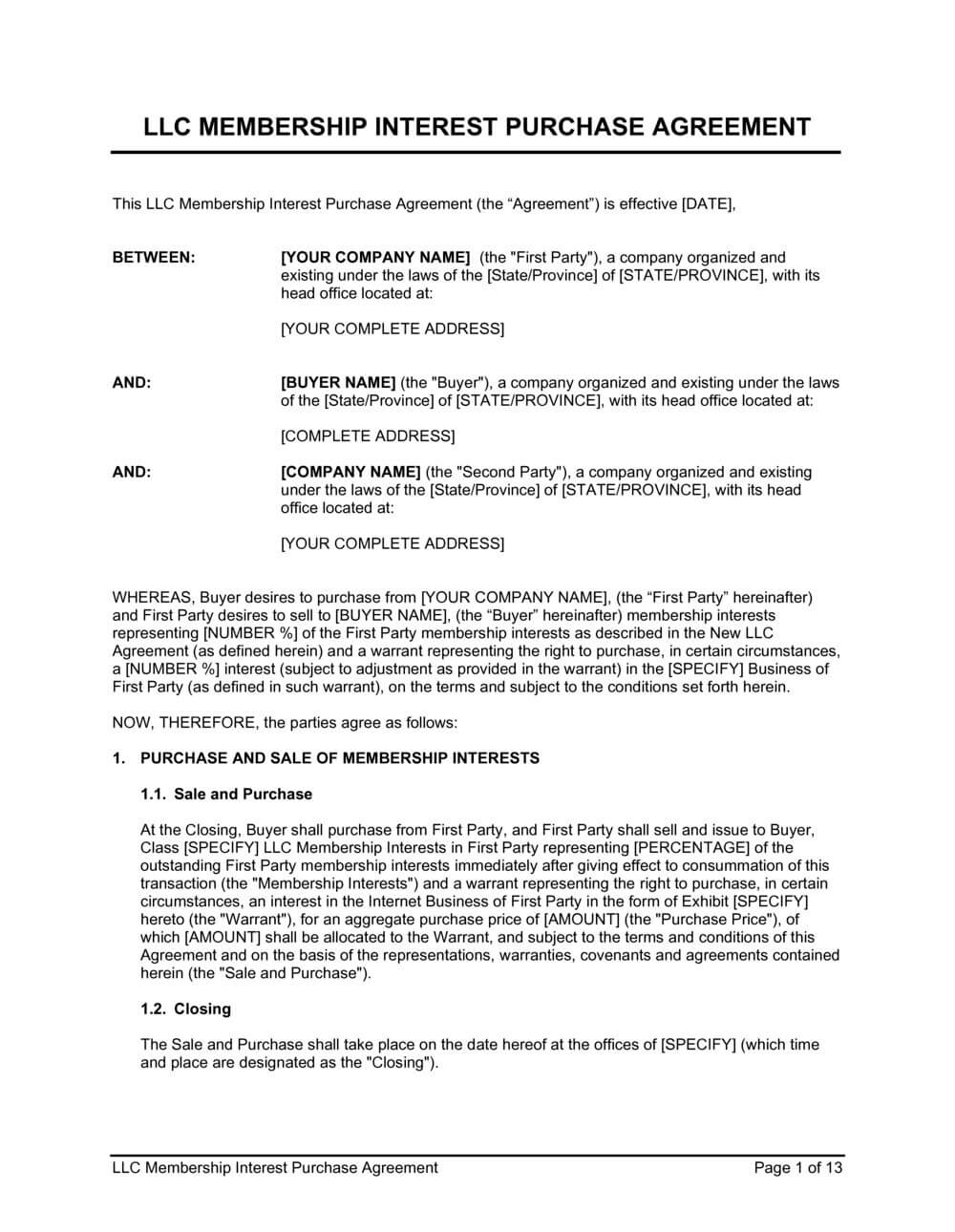

Step 3: Draft an Amendment or New Operating Agreement

Once member approval is secured, the next step is to formalize the change in writing. This ensures the new ownership structure is not just agreed upon verbally but legally documented and enforceable.

Depending on your situation, you’ll either draft an amendment to your existing operating agreement or, if the changes are extensive, create an entirely new agreement.

| 📝 Template for Adding New Members

“The Members hereby agree to admit [New Member’s Name] as a Member of the Company effective as of [Date]. [New Member’s Name] shall contribute [describe contribution: cash, property, or services] in exchange for a [X%] ownership interest in the Company, as reflected in the amended ownership structure attached hereto.” |

What to Include in Your Amendment

A well-drafted amendment should be precise and leave no room for ambiguity. At minimum, it should include the following:

- LLC name and state of operation exactly as listed in your Articles of Organization.

- Amendment date, clearly noting when the change takes effect.

- Reference to the section being amended, so there’s no confusion about which part of the agreement is changing.

- A clear statement of intent to amend the chosen section.

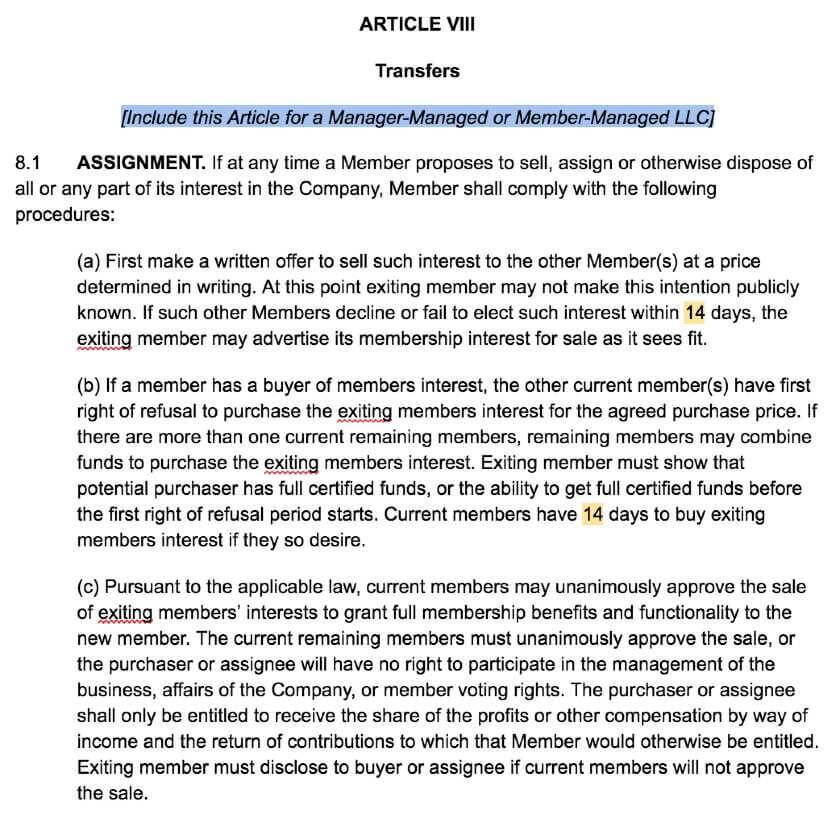

- Details of the amendment, including the new ownership structure, voting rights, profit-sharing terms, and even protocols if a member decides to sell a part of their stake.

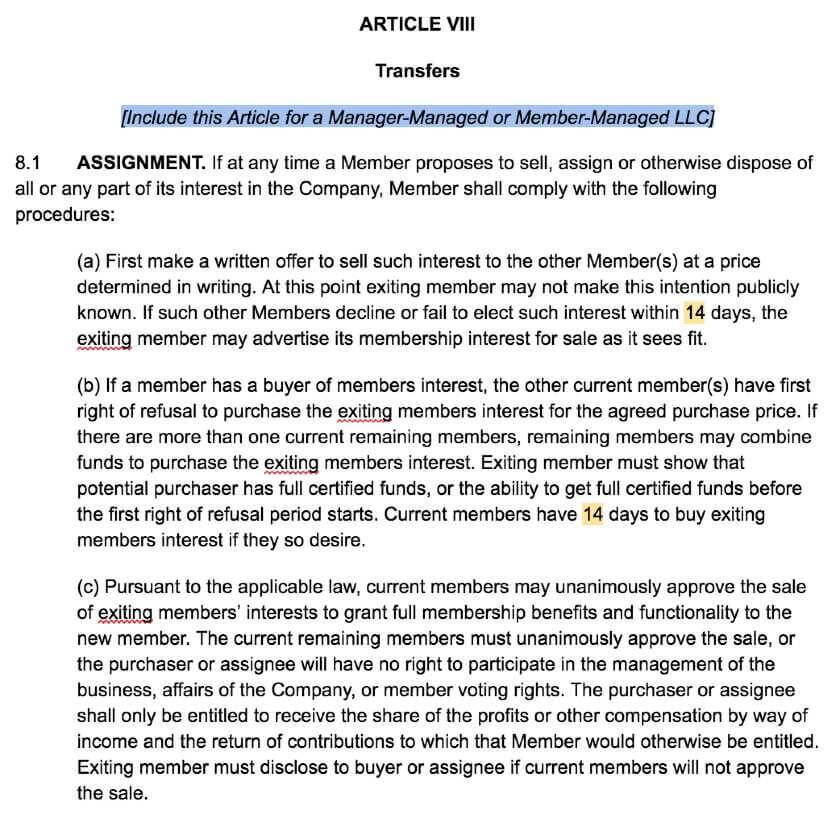

For instance, the image below (sample section of an amendment) demonstrates how an amendment can define the process for ‘transferring or selling’ an LLC member’s interest.

- A reaffirmation clause stating that all other sections of the operating agreement remain unchanged and in force.

- A compliance statement confirming that the amendment process followed the procedures outlined in the original operating agreement.

- Signatures of all authorized members or managers, ensuring the amendment is binding.

✔️ Other Considerations

This step is also a good opportunity to revisit your LLC’s management structure.

Do you want it to remain member-managed, where all members have decision-making authority, or shift to a manager-managed model, where selected individuals (or even outside managers) oversee daily operations?

Deciding now can prevent disputes later.

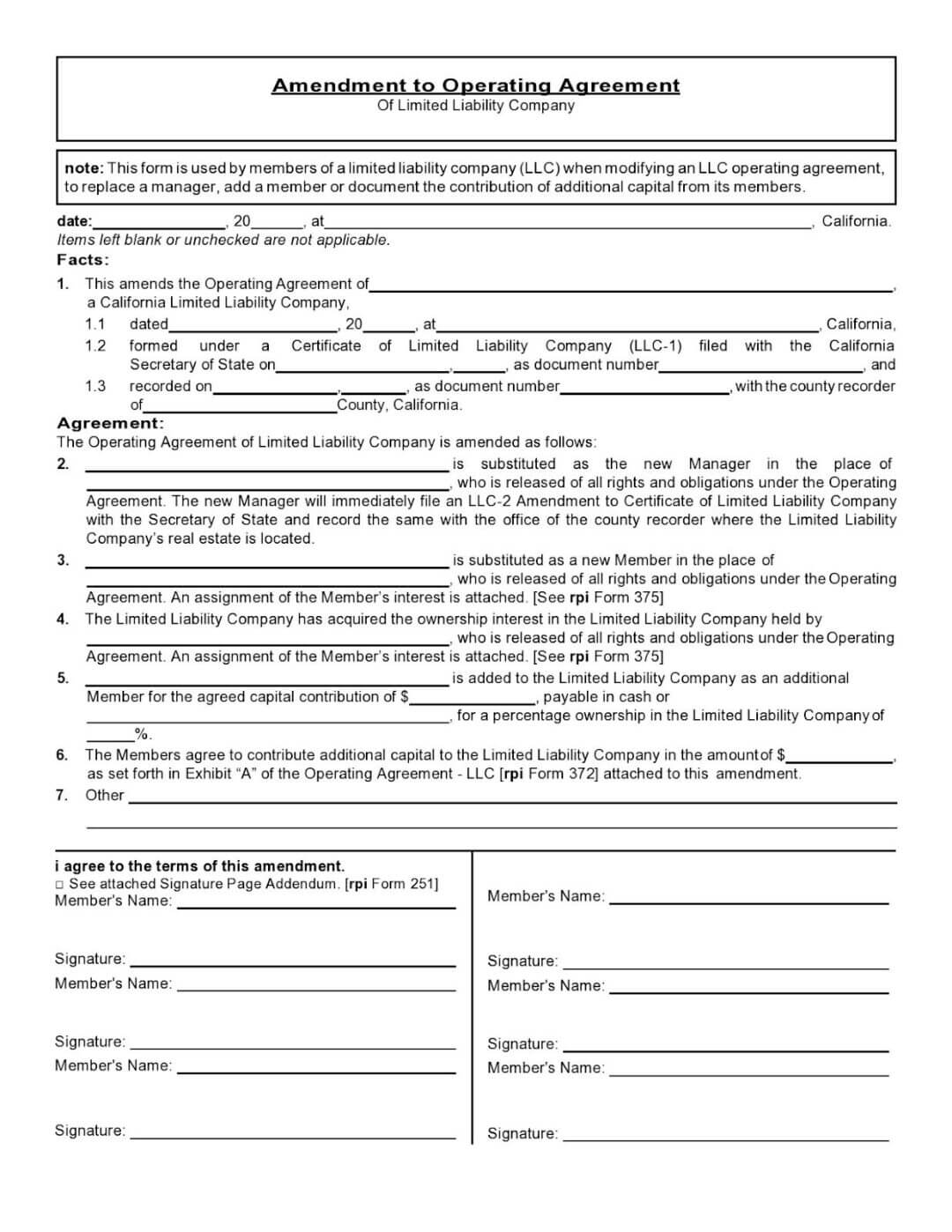

📌 Don’t forget to check your state’s filing requirements

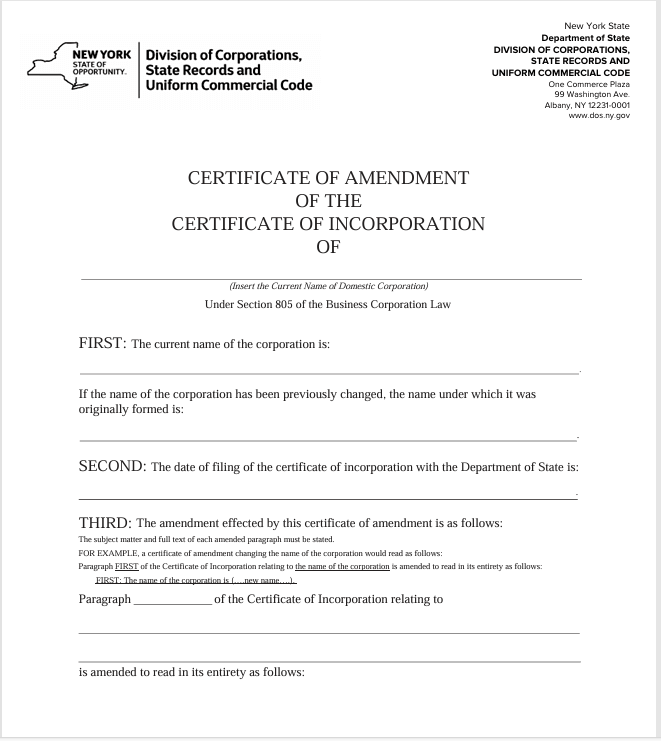

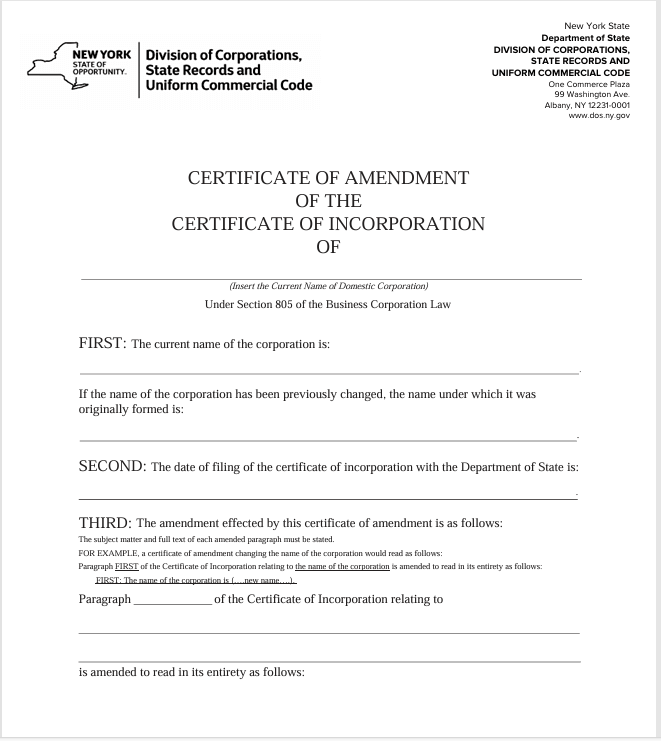

In some states, amendments must be filed with the Secretary of State or equivalent agency, sometimes online, sometimes via paper forms. Here’s an example for you to refer to:

Filing fees typically run around $100, but they vary by jurisdiction. If a certified copy of the amendment isn’t included in that fee, you’ll need to request (and pay for) one separately to keep in your records.

Step 4: File with the State (if required)

After you’ve finalized your amendment or new operating agreement, the next step is determining whether your state requires you to file an amendment with the Secretary of State (or equivalent agency).

This filing updates your official Articles of Organization to reflect changes in ownership or membership.

Not every state mandates this step. Some states only require internal record-keeping, while others require you to formally file an amendment.

Failing to comply in states that require filings can result in penalties or your amendment not being legally recognized.

What Documents to Submit (if your state requires filing):

- Articles of Amendment (or Certificate of Amendment): This is the most common form you’ll file to update your LLC’s ownership or membership structure.

- Updated Articles of Organization (if required): Some states may ask you to restate your Articles entirely, not just file an amendment.

- Amended Operating Agreement: While usually kept internally, some states allow or require you to submit this for official record-keeping.

- State-Specific Forms: Certain states have their own forms for reporting membership changes, always check your Secretary of State’s website for exact requirements.

- Filing Fee Payment: Fees vary by state, typically ranging from $20 to $150 (sometimes more in states like California or New York).

📌 Examples of State Filing Requirements

Here’s a snapshot of how this works in a few major states:

| State | Filing Requirement | Filing Fee | Additional Notes |

| Delaware | Must file a Certificate of Amendment with the Division of Corporations. | $200 (standard filing fee) | Expedited processing available for $50–$1,000 depending on turnaround time. |

| California | Must file an Amendment to Articles of Organization (Form LLC-2). | $30 (amendment filing fee) | Certified copy will cost an additional $5. Processing may take 5–10 business days. |

| New York | Must file a Certificate of Amendment with the Department of State. | $60 (filing fee) | Expedited processing available for $25 (24 hours), $75 (same day), $150 (2 hours). |

| Texas | Must file a Certificate of Amendment with the Secretary of State. | $150 (filing fee) | Electronic filing via SOSDirect available. Expedited processing available for $25. |

📌 Note: Fees and requirements vary by state and are subject to change, so always confirm on your Secretary of State’s official website before filing.

Step 5: Update IRS and Tax Records

Adding a new member doesn’t just change your LLC’s ownership, it can also transform how your business is taxed. Getting this step right is crucial to avoid penalties and ensure smooth financial operations.

✔️ Obtain an Employer Identification Number (EIN)

If your LLC was previously a single-member entity, you were likely using your Social Security number for federal taxes.

Once you add additional members, the IRS generally requires your LLC to have an EIN.

This becomes the official federal tax ID for your multi-member LLC and is required for filing tax returns, opening business bank accounts, and reporting income to new members.

✔️ Understand Your Tax Classification

- Single-member to multi-member LLC: Your LLC will now typically be taxed as a partnership. Each member must receive a Schedule K-1, which reports their share of profits, losses, and other tax items.

These elections impact how profits are taxed, how distributions are handled, and your reporting obligations, so it’s important to choose wisely.

Reporting Ownership Transactions

If the new member is added by purchasing a portion of your LLC interest, this counts as a taxable transaction and must be reported on your personal tax return.

Similarly, if the member receives an equity interest in exchange for contributions, the IRS may treat it as a taxable event based on the fair market value of the interest. Proper reporting ensures transparency and prevents future tax disputes.

If you aren’t sure how your business should be taxed with the addition of a new member (or members), doola’s tax experts can help you navigate the process and determine the best tax status for your LLC. You can sign up with us to get more information.

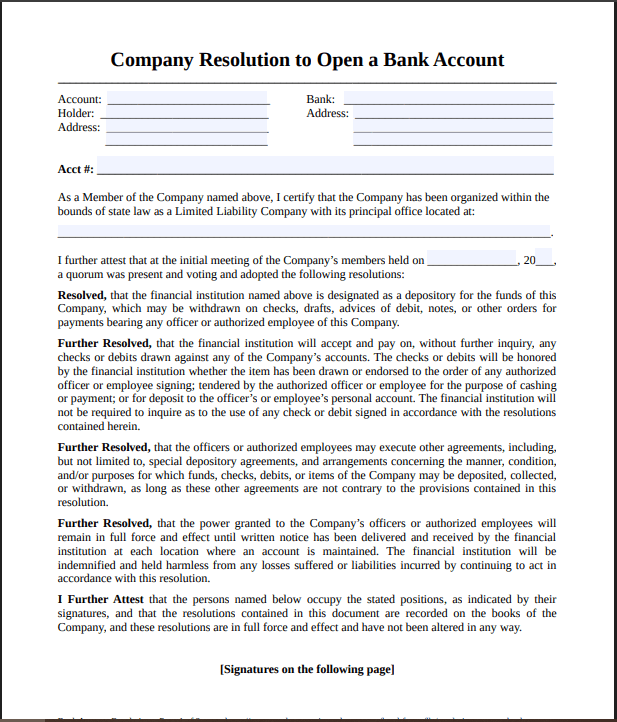

Step 6: Update Banking & Financial Accounts

Once your new member is officially added to the LLC, it’s critical to ensure that your banking and financial accounts reflect the change. This step safeguards smooth transactions, maintains compliance, and prevents potential disputes over access or authority.

Why This Matters

If your new member will have access to company funds or financial decision-making authority, banks, accounting systems, and payment processors all need to be updated. This ensures that:

- The new member can legally transact on behalf of the LLC.

- Ownership stakes are properly reflected in accounting and financial reporting.

- All signatories and permissions align with your operating agreement.

📌 Steps to Update Your LLC’s Bank Account and Financial Systems

1. Gather Required Documentation: Collect the documents that verify the new member’s addition:

- Amended operating agreement or member resolution signed by existing members

- Identification and contact details of the new member

- Any internal resolutions authorizing the new member to access company funds

2. Contact Your Bank: Reach out to your bank’s business banking department to:

- Notify them of the new member

- Confirm the exact forms and documents needed to update signatories

- Ask if an in-person visit is required (most banks do require verification from all signatories)

3. Complete Bank Forms: Fill out the necessary forms to:

- Add the new member as an authorized signatory

- Update withdrawal and transaction limits in accordance with the operating agreement

4. Visit the Bank (if required): Many banks require all authorized individuals to appear in person for verification. Bring all identification and amended LLC documents to complete the process.

5. Update Financial Systems:

- Signatories and Roles: Ensure the new member is listed as an authorized signer and that their rights align with the operating agreement.

- Accounting Software: Reflect the new member’s ownership percentage, profit share, and any role changes in your accounting system.

- Payment Processors and Payroll Services: Update all platforms where the new member will manage transactions, payables, or payroll functions.

By systematically updating banking and financial accounts, you protect your LLC’s financial integrity and ensure that all members’ roles are transparent and legally enforceable.

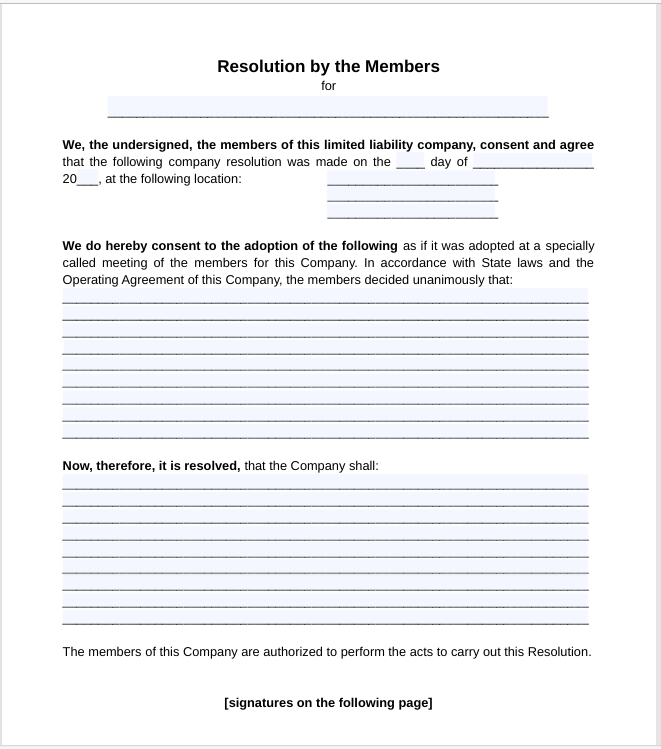

Step 7: Keep Internal Records

As a final step, keep everything documented: your signed amendments, updated operating agreements, and even official meeting minutes. This ensures legal enforceability, and protects your LLC in case of disputes or audits.

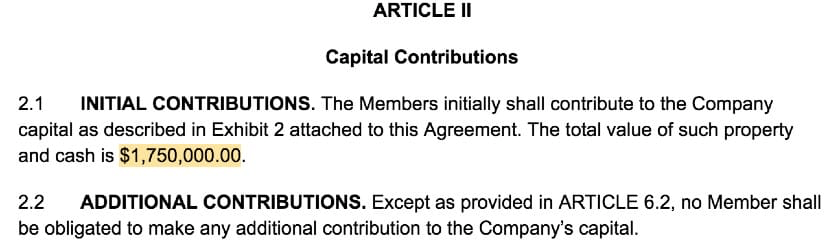

For example, here’s how the distribution of capital contributions by LLC members can be determined and documented.

Essential Internal Records to Create or Update

Internal Record

Purpose / Key Details

LLC Operating Agreement

Amend to reflect new member(s), ownership changes, and updated voting/management rights. Serves as the foundation of LLC operations and defines member responsibilities.

LLC Admission Agreement

Formally documents the new member’s entry. Include member name, contribution type (capital, property, services), payment terms, and use of contributions.

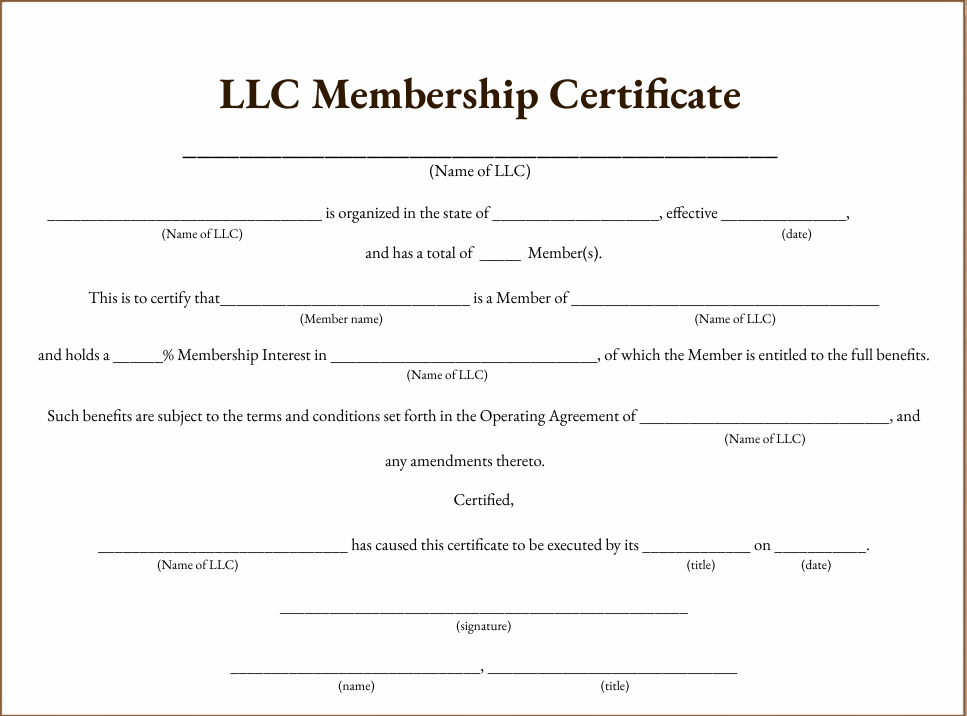

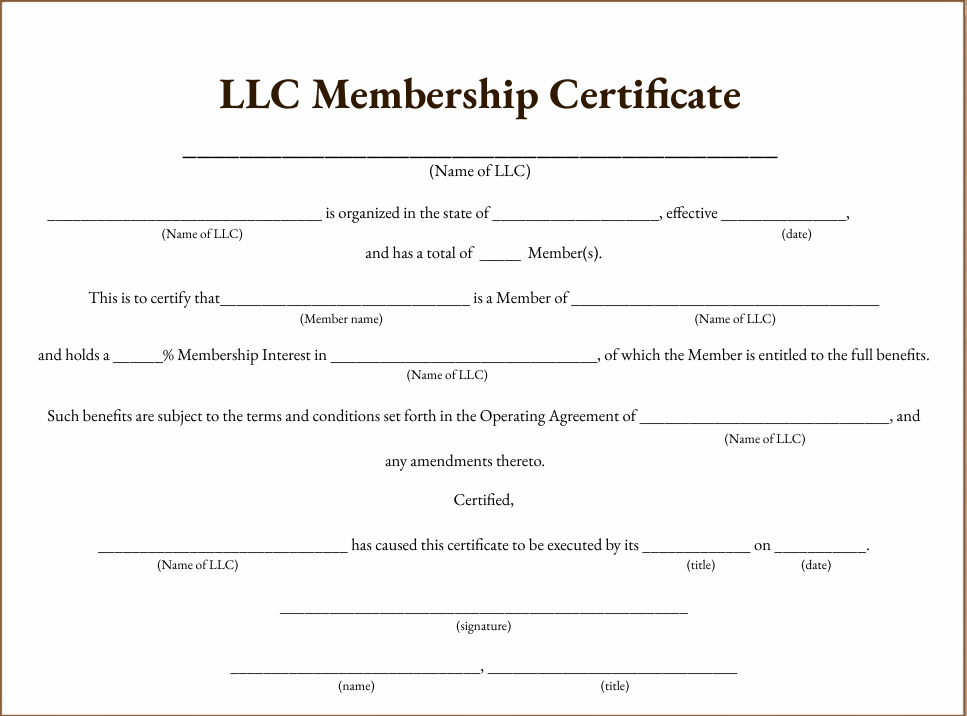

Membership Certificate

Issue physical or digital certificate showing the new member’s ownership stake. Record in membership transfer ledger for clear ownership history.

Capital Account & Contribution Records

Track all capital contributions, including the new member’s and any adjustments to existing members’ accounts. Ensures transparent profit-sharing and equity records.

Meeting Minutes

Record the official decision to add the new member, including who voted, vote tally, and final decision. Serves as legal proof of approval.

When your documentation is complete, your LLC’s membership changes are fully formalized, compliant, and ready for smooth operations moving forward.

And if managing all these steps seems like a lot, don’t worry, doola is here to simplify the process and keep your business moving forward.

Legal and Tax Considerations

Adding new members to your LLC isn’t just a matter of “sign and go.” Beyond just a simple administrative task, it carries real legal and tax implications that can impact your business for years.

Here are the key considerations you need to understand upfront:

1. Tax Implications: Adding members can change your LLC’s IRS classification. For example, a single-member LLC is usually treated as a disregarded entity, but adding members may shift your LLC to a partnership for federal tax purposes.

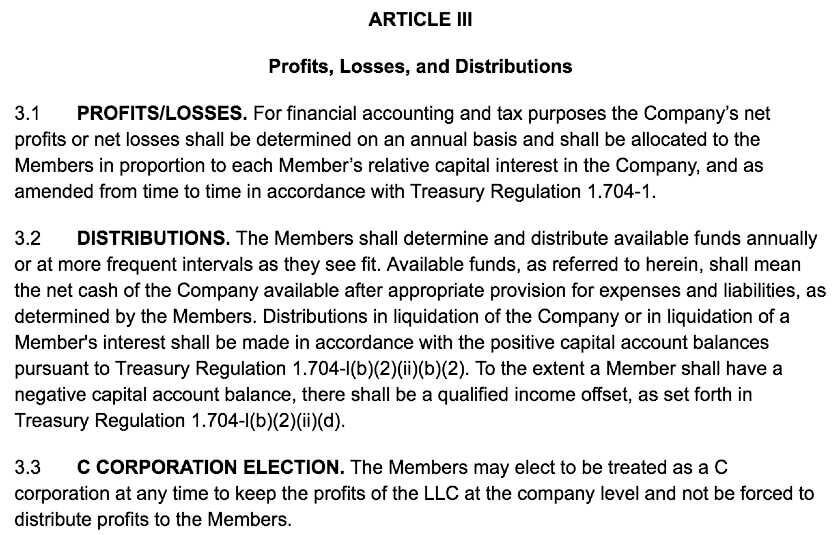

This affects how profits, losses, and distributions are reported, so you need to plan accordingly.

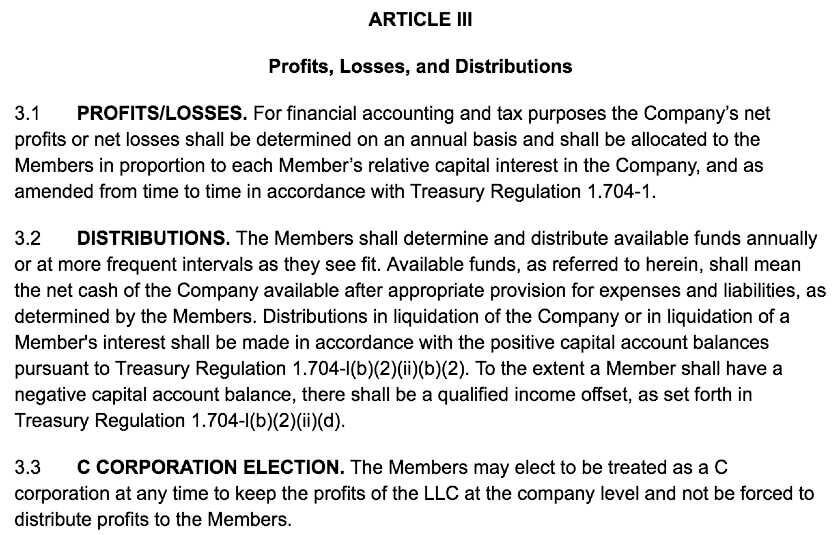

Here’s an example of how profit and loss along with distributions need to be explicitly declared in an operating agreement.

2. New EIN Requirements: Depending on your LLC’s tax classification and the nature of the ownership changes, the IRS may require a new Employer Identification Number (EIN).

3. Legal Risks: Failing to properly document the addition of new members can leave your LLC vulnerable to disputes or lawsuits. Clear, written agreements, signed amendments, and properly recorded resolutions are critical for protecting the LLC and its members.

4. Transparency and communication: All existing members must be kept fully informed of proposed changes. Hidden deals, unclear agreements, or unilateral decisions can spark serious conflict and jeopardize trust within your LLC. Clear ‘communication and approvals’ are essential.

Don’t leave your LLC’s growth to chance, sign up with doola today and let us guide you through every step of adding members safely and efficiently.

Common Mistakes to Avoid When Adding New LLC Members

The most well-intentioned entrepreneurs can also stumble when amending their LLC operating agreement.

So next, let’s break down the most common pitfalls, the real-world consequences they can cause, and how to fix them before they escalate.

❌ Not Documenting Changes Properly

Mistake: Relying on a handshake or verbal agreement instead of formally amending the operating agreement.

Business Impact: Without written documentation, the new member’s rights, ownership percentage, and profit share can be disputed in court, leading to costly legal battles and damaged trust.

Solution: Always put changes in writing through a proper amendment. Get all members’ signatures and keep the updated agreement in your official business records.

❌ Skipping Unanimous Consent

Mistake: Adding a member without the required approval of all existing members.

Business Impact: If your state law or your original operating agreement requires unanimous consent, skipping this step can make the amendment legally invalid. This means the new member may not be recognized by banks, the IRS, or even in court.

Solution: Review your operating agreement and state laws before proceeding. If unanimous consent is required, make sure every current member signs off before finalizing the amendment.

❌ Forgetting to Update Accounts and Registrations

Mistake: Failing to notify banks, the IRS, or key vendors of your new ownership structure.

Business Impact: Banks may freeze access to business accounts, the IRS may send incorrect tax notices, and vendors could refuse contracts if records don’t match your ownership details. These oversights can disrupt daily operations and cash flow.

Solution: As soon as the operating agreement is updated, notify all relevant institutions: banks, tax authorities, vendors, and licensing agencies, so your business stays compliant and runs smoothly.

❌ Not Clarifying Roles and Responsibilities

Mistake: Adding a member without defining their duties, voting rights, or management authority.

Business Impact: Ambiguity creates tension, misunderstandings, and disputes over who makes decisions, how profits are divided, and who is accountable for day-to-day operations.

Solution: Spell out each member’s role clearly in the operating agreement amendment. Define voting powers, profit allocations, and responsibilities to ensure smooth collaboration and avoid conflicts down the road.

By avoiding these common mistakes, you’ll be able to safeguard your LLC’s legal standing, protect relationships with members, and maintain credibility with banks, vendors, and regulators.

How doola Can Help Your LLC With The Next Steps

Updating your LLC’s operating agreement doesn’t have to feel overwhelming, doola is here to make it effortless.

With doola, you get:

- Seamless LLC formation and compliance support so your business is set up right from the start.

- Expert guidance on your operating agreement, ensuring all changes are legally sound and fully documented.

- Catch-up bookkeeping that keeps your finances organized, investor-ready, and tax-compliant.

- Ongoing compliance reminders so you never miss a filing or deadline.

With our expert team by your side, you’re not just updating documents, you’re also steering your business toward long-term success with confidence.

Sign up to get started!

FAQs

Do all LLC members need to agree before adding a new member?

It depends on your operating agreement and state law. Some require unanimous consent; others allow majority approval.

Can I add members to a single-member LLC?

Yes, but it changes your tax status, you’ll likely shift from sole proprietorship to partnership taxation.

Do I need to file an amendment with my state when adding LLC members?

Some states require this, others don’t. Always check your state’s specific rules.

How does adding members affect LLC taxes?

Your LLC may move from disregarded entity taxation to partnership or even elect S Corp status depending on your setup.

Can new members have different voting or profit-sharing rights?

Yes, new members have different voting or profit-sharing rights as long as the operating agreement clearly defines these rights.

What documents should I keep after updating my LLC operating agreement?

You should keep signed amendments, updated agreements, and meeting minutes after updating your LLC operating agreement.

Can doola help if my LLC is already formed but I need to add members?

Absolutely! doola can assist with amendments, compliance, and ongoing support.

News

Berita

News Flash

Blog

Technology

Sports

Sport

Football

Tips

Finance

Berita Terkini

Berita Terbaru

Berita Kekinian

News

Berita Terkini

Olahraga

Pasang Internet Myrepublic

Jasa Import China

Jasa Import Door to Door

Download Film

Gaming center adalah sebuah tempat atau fasilitas yang menyediakan berbagai perangkat dan layanan untuk bermain video game, baik di PC, konsol, maupun mesin arcade. Gaming center ini bisa dikunjungi oleh siapa saja yang ingin bermain game secara individu atau bersama teman-teman. Beberapa gaming center juga sering digunakan sebagai lokasi turnamen game atau esports.

Comments are closed, but trackbacks and pingbacks are open.